There is no gentle way to say it: general contractors need to make sure they are properly insured. Below is a crash course on general contractor insurance: the types of policies you might need, and what to look for in those policies.

Proper contractor insurance isn’t just about having a policy that satisfies a client’s insurance requirements on paper. Real insurance means having policies that will actually pay when an accident happens: if an employee falls off a ladder and can’t work for months, if an uninvited visitor wanders onto your job site and gets injured, if a disconnected sump pump causes an unexpected flood, or if some other accident opens your business up to a costly lawsuit. And it means having a broker who has reviewed every exclusion in your policy, so you know exactly what is covered and what is not.

Here is a handy guide on how to make sure your construction business is properly insured.

Types of Policies a Contractor Should Have

General Liability: This insurance protects you in case somebody gets injured because of your work. Perhaps a tool falls off a roof and lands on a passer-by, or a client falls into a trench while visiting the job site, or some other kind of unexpected accident. Injuries can happen in construction, and this insurance will pay to defend you if the injured party accuses you of being liable for the accident. This insurance also pays if property is damaged during the course of your work. That wrench might falls and damage a parked car, and general liability will pay for the repairs, as well as any legal fees. This is the insurance most often required by clients, so you’ll probably need it before you can start most jobs.

Workers Comp: This insurance is a requirement not only from clients, but also from the state. Workers comp protects your workers in the event of injury, and protects you in the event an injured worker claims that your business was liable for the injury. Even if you only have one part-time employee, you must carry workers comp. Not only is it required by the state and the CSLB, but it’s also just smart: the carrier will pay the injured worker’s hospital bills so that you won’t have to. They may even cover the employee’s lost wages, and protect you, the employer, from liability. Bonus: when you buy workers comp, we will automatically send proof to the CSLB so they know you are compliant.

Tools and Equipment: This insurance is also known as Inland Marine, even if you never go anywhere near the water. An Inland marine policy covers your equipment big and small, from large excavators down to small misc. tools. Since your work happens all over the place at various job sites, this insurance follows you wherever you go. And if you have an office or warehouse, it can also insure all the office equipment and machinery in your space. If you lease or purchase large equipment (like an excavator, large drill, skid steer, etc.), this type of insurance will likely be required by the lender.

Commercial Auto: Oftentimes a new general contractor just starting out in the business will only own one important piece of equipment: a truck. Therefore a commercial auto policy is an important piece of this insurance puzzle: it protects your vehicle, it protects your liability on the road and at job sites, and it protects other drivers. A personal auto policy will not suffice if you are using your truck to haul materials, if your business name is on the truck, or if your employees drive the vehicle. Only a commercial policy can guarantee you’ll be protected in case you back your truck into a building at a job site, drop materials onto the road while driving, or if your employee collides with another driver on the way to a job.

Umbrella: As you start to take on larger jobs, or perform work for commercial entities (like owners of strip malls, apartment buildings, or HOAs), you may find that they require you to carry more liability than what is provided by a standard general liability policy. This is where an umbrella comes in: it provides additional liability to meet such requirements, whether the requirement be $1m, $3m, $5m, or more. An umbrella is especially handy because it can extend additional liability over ALL of your other policies, including general liability, auto, and workers comp. This means that one umbrella can actually increase the limits on all your other policies, protecting you from the types of larger lawsuits that sometimes come from performing work on larger properties.

These are the main types of insurance policies that most general contractors need, though your specific may vary depending on the types of jobs you perform, the size of clients you take on, and how much equipment you own.

Look out for exclusions!

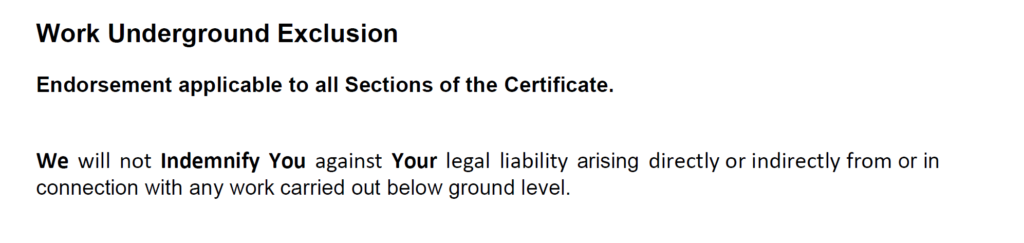

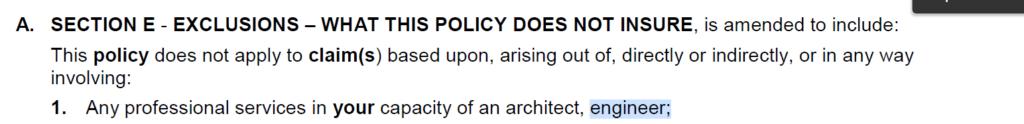

Having the insurance is one thing, but making sure it actually covers your operations is another. As I noted in my article on earthquake retrofitter insurance, it is crucial to work with a broker who will review the exclusions in your policy. Sometimes policies that are very cheap are also riddled with exclusions. Those carriers may refuse to cover work performed underground, work on foundations, new construction, exterior work over 3 stories high, work performed on HOAs, etc. etc.!

The only way to make sure that your policy is a good fit to to review it, and that is the job of your broker. Some general contractors, especially those who specialize in home remodels, might find that the lowest-cost policy is a perfect fit, since they don’t perform the kind of work those policies exclude. Whereas companies that specialize in foundation repair, demolition, exterior painting, roofing, new construction, and other specific areas of expertise might need a policy that is specifically designed to cover their type of work.

Since we specialize in general contractor insurance, we know what to look for in a contractor’s policy. We aren’t just looking to offer the quickest, cheapest option, but also the CORRECT option, the policy that properly insures the construction company. If your insurance doesn’t cover you properly, why bother paying for it!

As brokers, we will shop around for you, make sure we find all the most competitive quotes available on the market, and review them carefully to make sure they do the job. This is not a one-time service, but something we automatically do every year at renewal. That way you will know that every year you’ve got the best possible deal and best possible coverage. And as your business grows and changes (perhaps your services or types of clientele change drastically over the years), we will make adjustments as needed. In other words, we are people you can talk to over the course of years, not anonymous sales drones who become impossible to reach the second they close the deal.

Contact us today to find out what insurance your business needs.